Rating: 9/10

See book on Amazon.

High-level thoughts

While some chapters and concepts presented in this book are stronger than others, I enjoyed it thoroughly while taking my time to properly digest all the learnings.

It's one of those books that you have to read if you work in sales or technology.

Why?

Because it brings you a good mental model for understanding modern high-tech marketing, as well as the importance of segmenting and understanding your customers in a manner that I haven't seen anywhere else.

I've read online that many readers valued the material in the book, but it didn’t really tell them anything they didn’t know already. While I agree with some of them, what happened in my case was that it captured and brought together so many scattered intuitions and disparate observations, aligning them nicely into a coherent set of frameworks that can be used for effective decision making and execution.

Although it's been revised twice, some parts of the book can feel slightly dated, the latest revision having come out in 2014. I have to say it didn't bother me at all while I read it, but I can understand that modern "Growth Hackers" and other actively practicing professionals can feel that way.

On this page you will find a table of contents and a logical rundown of the greatest bits that I took out for myself.

As a side note: Later when Geoffrey talks about the "whole product" and namely alliances and partners, I think the best book on the topic is Hans Peter Bech's: Building Successful Partner Channels: Channel Development & Management in the Software Industry, which I will try to summarize (much more briefly) on this site at some point in the future.

If you enjoy what you read and would like to receive a very occasional, hand-crafted update from me into your inbox, feel free to sign up below. Here are some previous issues of the newsletter.

Table of Contents

- What's happening? A high-level perspective

- Basics: Markets and segmentation

- Example: Early adopters vs. early majority

- What is the "Chasm"?

- Technology Adoption Lifecycle

- Chasm as the single biggest challenge

- Starting to cross the chasm

- A war analogy

- How does the "D-Day" strategy help companies cross the chasm?

- Being sales vs. market driven when crossing the chasm

- Choosing the beachhead segment

- Tips on whole product management

- Define the battle

- Launching the invasion

- Leaving the chasm behind

- R&D decisions: From products to whole products

- Conclusion

What's happening? A high-level perspective

It is not uncommon for a high-tech company to announce a modest shortfall in its quarterly projections and incur a 30 percent devaluation in stock price on the following day of trading.

As the kids like to say: What’s up with that? There are, however, more serious ramifications.

High-tech innovation and marketing expertise are two cornerstones of the U.S. strategy for global competitiveness. We will never have the lowest cost of labor or raw materials, so we must continue to exploit advantages further up the value chain. If we cannot at least learn to predictably and successfully bring high-tech products to market, our countermeasures against the onslaught of commoditizing globalization will falter, placing our entire standard of living in jeopardy.

Basics: Markets and segmentation

If two people buy the same product for the same reason but have no way they could reference each other, they are not part of the same market.

That is, if I sell an oscilloscope for monitoring heartbeats to a doctor in Boston and the identical product for the same purpose to a doctor in Zaire, and these two doctors have no reasonable basis for communicating with each other, then I am dealing in two different markets. Similarly, if I sell an oscilloscope to a doctor in Boston and then go next door and sell the same product to an engineer working on a sonar device, I am also dealing in two different markets. In both cases, the reason we have separate markets is that the customers could not have referenced each other.

The way around this problem for many marketing professionals is to break up the category into isolable “market segments.” Market segments, in this vocabulary, meet our definition of markets

When marketing consultants sell market segmentation studies, all they are actually doing is breaking out the natural market boundaries within an aggregate of current and potential sales. Marketing professionals insist on market segmentation because they know that no meaningful marketing program can be implemented across a set of customers who do not reference each other. The reason for this is simply leverage. No company can afford to pay for every marketing contact made. Every program must rely on some ongoing chain-reaction effects—what is usually called word of mouth.

The more self-referencing the market and the more tightly bounded its communications channels, the greater the opportunity for such effects.

Example: Early adopters vs. early majority

What the early adopter is buying, is some kind of change agent. By being the first to implement this change in their industry, the early adopters expect to get a jump on the competition, whether from lower product costs, faster time to market, more complete customer service, or some other comparable business advantage.

They expect a radical discontinuity between the old ways and the new, and they are prepared to champion this cause against entrenched resistance. Being the first, they also are prepared to bear with the inevitable bugs and glitches that accompany any innovation just coming to market.

By contrast, the early majority (pragmatists) want to buy a productivity improvement for existing operations. They are looking to minimize the discontinuity with the old ways. They want evolution, not revolution. They want technology to enhance, not overthrow, the established ways of doing business. And above all, they do not want to debug somebody else’s product. By the time they adopt it, they want it to work properly and to integrate appropriately with their existing technology base.

These differences just scratch the surface relative to the differences and incompatibilities among early adopters and the early majority.

Two key points for now:

- Because of these incompatibilities, early adopters do not make good references for the early majority.

- And because of the early majority’s concern not to disrupt their organizations, good references are critical to their buying decisions.

So what we have here is a catch-22. The only suitable reference for an early majority customer, it turns out, is another member of the early majority, but no upstanding member of the early majority will buy without first having consulted with several suitable references.

What is the "Chasm"?

We have enough high-tech marketing history now to see where our model has gone wrong and how to fix it. To be specific, the point of greatest peril in the development of a high-tech market lies in making the transition from an early market dominated by a few visionary customers to a mainstream market dominated by a large block of customers who are predominantly pragmatists in orientation.

The gap between these two markets, all too frequently ignored, is in fact so significant as to warrant being called a chasm, and crossing this chasm must be the primary focus of any long-term high-tech marketing plan.

One of the most important lessons about crossing the chasm is that the task ultimately requires achieving an unusual degree of company unity during the crossing period. This is a time when one should forgo the quest for eccentric marketing genius in favor of achieving an informed consensus among mere mortals.

It is a time not for dashing and expensive gestures but rather for careful plans and cautiously rationed resources — a time not to gamble all on some brilliant coup but rather to focus everyone on pursuing a high-probability course of action and making as few mistakes as possible.

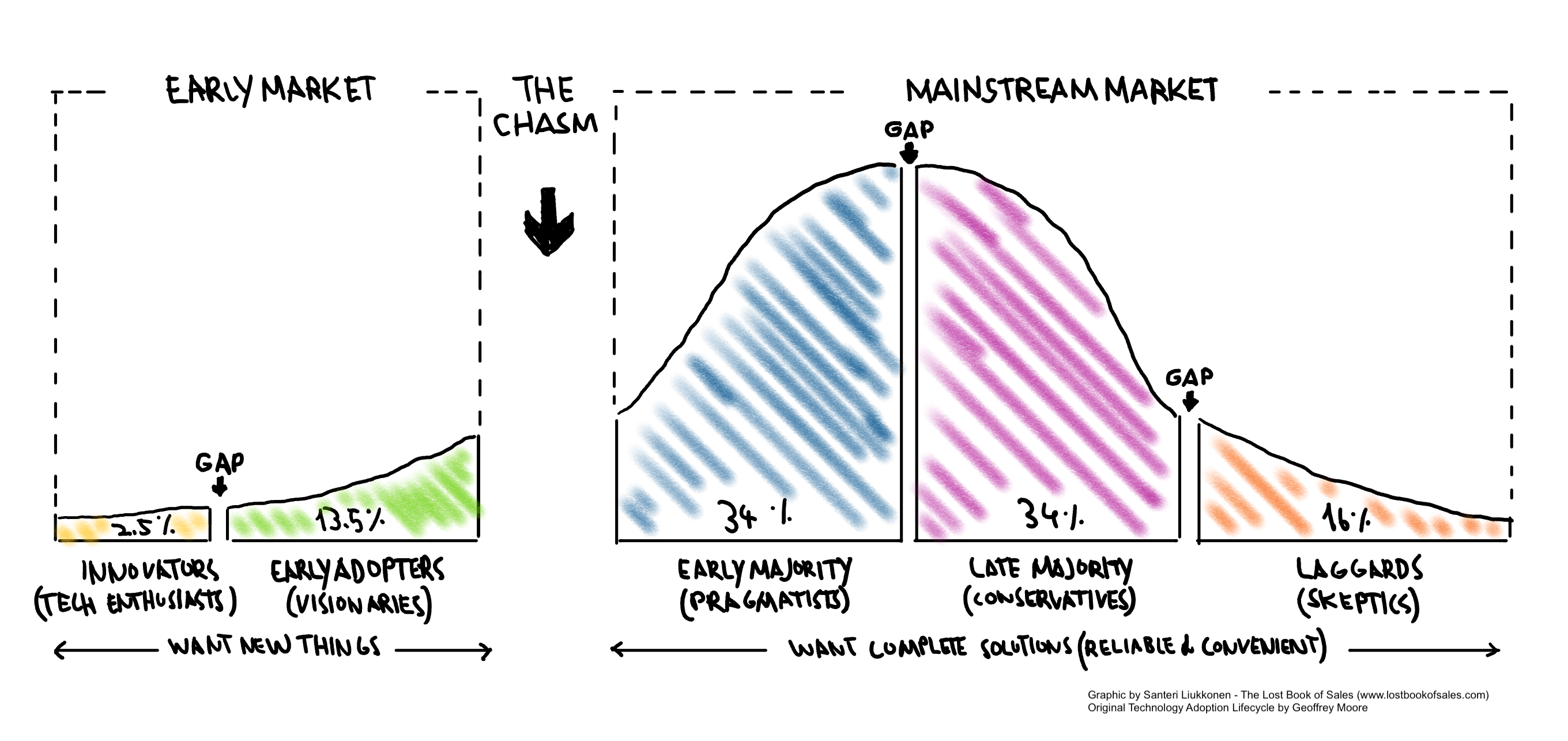

Technology Adoption Lifecycle

Each group in this model represents a unique psychographic profile (i.e. a combination of psychological and demographical traits) that makes its marketing responses different from those of the other groups.

By understanding the differences of these groups, marketeers are better able to target all of these consumers with the right marketing techniques.

Let's go through each group starting from the left.

Innovators (Technology Enthusiasts)

Innovators are the first group of people that are likely to invest in your product, since they pursue new technology products aggressively. They sometimes even seek them out even before a formal marketing program has been launched. This is because technology is a central interest in their life, regardless of what function it is performing.

The drawbacks are that there aren’t a lot of Innovators (roughly 2.5%) in any given market segment and they are usually not willing to pay a lot for new products.

However, winning them over is important nonetheless, because their endorsement reassures the other consumers in the marketplace that the product could in fact work. Furthermore, these tech enthusiasts can serve well as a test group in order to make the necessary modifications before targeting the mainstream.

Early adopters | Visionaries

The key point is that, in contrast with the technology enthusiast, a visionary focuses on value not from a system’s technology per se but rather from the strategic leap forward such technology can enable.

Visionaries drive the high-tech industry because they see the potential for an “order-of-magnitude” return on investment and willingly take high risks to pursue that goal. They will work with vendors who have little or no funding, with products that start life as little more than a diagram on a whiteboard, and with technology gurus who bear a disconcerting resemblance to Rasputin. They know they are going outside the mainstream, and they accept that as part of the price you pay when trying to leapfrog the competition

Finally, beyond fueling the industry with dollars, visionaries are also effective at alerting the business community to pertinent technology advances. Outgoing and ambitious as a group, they are usually more than willing to serve as highly visible references, thereby drawing the attention of the business press and additional customers to small fledgling enterprises.

As a buying group, visionaries are easy to sell but very hard to please. This is because they are buying a dream that, to some degree, will always be a dream. The “incarnation” of this dream will require the melding of numerous technologies, many of which will be immature or even nonexistent at the beginning of the project. The odds against everything falling into place without a hitch are astronomical. Nonetheless, both the buyer and the seller can build successfully on two key principles.

First, visionaries like a project orientation. They want to start out with a pilot project, which makes sense because they are “going where no man has gone before,” and you are going there with them. This is followed by more project work, conducted in phases, with milestones, and the like.

The visionaries’ idea is to be able to stay very close to the development train to make sure it is going in the right direction and to be able to get off if they discover it is not going where they thought. While reasonable from the customer’s point of view, this project orientation is usually at odds with the intentions of entrepreneurial vendors who are trying to create a more universally applicable product around which they can build a multi-customer business. This is potentially a lose-lose situation threatening both the quality of the vendor’s work and the fabric of the relationship, and it requires careful account management including frequent contact at the executive level.

The winning strategy is built around the entrepreneur being able to “productize” the deliverables from each phase of the visionary project. That is, whereas for the visionary the deliverables of phase one are only of marginal interest—proof of concept with some productivity improvement gained, but not “the vision”—these same deliverables, repackaged, can be a whole product to someone with less ambitious goals.

The most important principle stemming from all this is the emphasis on management of expectations. Because controlling expectations is so crucial, the only practical way to do business with visionaries is through a small, top-level direct sales force. At the front end of the sales cycle, you need such a group to understand the visionaries’ goals and give them confidence that your company can step up to them. In the middle of the sales cycle, you need to be extremely flexible about commitments as you begin to adapt to the visionaries’ agenda. At the end, you need to be very careful in negotiations, keeping the spark of the vision alive without committing to tasks that are unachievable within the time frame allotted. All this implies a mature and sophisticated representative working on your behalf.

Early majority | Pragmatists

When pragmatists buy, they care about the company they are buying from, the quality of the product they are buying, the infrastructure of supporting products and system interfaces, and the reliability of the service they are going to get. In other words, they are planning on living with this decision personally for a long time to come. (By contrast, the visionaries are more likely to be planning on implementing the great new order and then using that as a springboard to their next great career step upward.) Because pragmatists are in it for the long haul, and because they control the bulk of the dollars in the marketplace, the rewards for building relationships of trust with them are very much worth the effort.

Even if pragmatists are hard to win over, they are loyal once won, often enforcing a company standard that requires the purchase of your product, and only your product, for a given requirement. This focus on standardization is, well, pragmatic, in that it simplifies internal service demands. But the secondary effects of this standardization on your growth and profitability — increasing sales volumes and lowering the cost of sales — is dramatic. Hence the importance of pragmatists as a market segment.

Pragmatists tend to be “vertically” oriented, meaning that they communicate more with others like themselves within their own industry than do technology enthusiasts and early adopters, who are more likely to communicate “horizontally” across industry boundaries in search of kindred spirits.

This means it is very tough to break into a new industry selling to pragmatists. References and relationships are very important to these people, and there is a kind of catch-22 operating: Pragmatists won’t buy from you until you are established, yet you can’t get established until they buy from you. Obviously, this works to the disadvantage of start-ups and, conversely, to the great advantage of companies with established track records.

On the other hand, once a start-up has earned its spurs with the pragmatist buyers within a given vertical market, they tend to be very loyal to it, and even go out of their way to help it succeed.

Pragmatists are reasonably price-sensitive. They are willing to pay a modest premium for top quality or special services, but in the absence of any special differentiation, they want the best deal. That’s because, having typically made a career commitment to their job and/or their company, they get measured year in and year out on what their operation has spent versus what it has returned to the corporation.

Overall, to market to pragmatists, you must be patient. You need to be conversant with the issues that dominate their particular business. You need to show up at the industry-specific conferences and trade shows they attend. You need to be mentioned in articles that run in the newsletters and blogs they read. You need to be installed in other companies in their industry. You need to have developed applications for your product that are specific to their industry. You need to have partnerships and alliances with the other vendors who serve their industry. You need to have earned a reputation for quality and service. In short, you need to make yourself over into the obvious supplier of choice.

One final characteristic of pragmatist buyers is that they like to see competition — in part to get costs down, in part to have the security of more than one alternative to fall back on should anything go wrong, and in part to assure themselves they are buying from a proven market leader. This last point is crucial: Pragmatists want to buy from proven market leaders because they know that third parties will design supporting products around a market-leading product. That is, market-leading products create an aftermarket that other vendors service. This radically reduces pragmatist customers’ burden of support. By contrast, if they mistakenly choose a product that does not become the market leader, but rather one of the also-rans, then this highly valued aftermarket support does not develop, and they will be stuck making all the enhancements by themselves. Market leadership is crucial, therefore, to winning pragmatist customers.

Late majority | Conservatives

The late majority catch on to a new innovation well after the average consumer does. This is usually due to a high level of skepticism about the benefits of a new product or service while having less financial flexibility than earlier adopters.

The late majority also commonly only interacts with early majority consumers serving as an indication the product has reached full maturity in the market.

Laggards | Sceptics

Laggards are the last group in the technology adoption stages. Laggards show an aversion to change and are not influenced by opinion leaders.

This group tends to focus more on the reliability of products they already use, but also may have very little financial flexibility to take risks when it comes to buying innovative products. Finally, this group of individuals tends to only be in contact with and trust close friends and family instead of influencers or early adopters.

Chasm as the single biggest challenge

In sum, when promoters of high-tech products try to make the transition from a market base made up of visionary early adopters to penetrate the next adoption segment, the pragmatist early majority, they are effectively operating without a reference base and without a support base within a market that is highly reference oriented and highly support oriented. This is indeed a chasm, and into this chasm many an unwary start-up venture has fallen.

Despite repeated instances of the chasm effect, however, high-tech marketing still struggles to get this problem properly in focus. In each case, the key to success is to focus in on the dominant “adoption type” in the current phase of the market, learn to appreciate that segment’s psychographics, and then adjust your marketing strategy and tactics accordingly.

The basic flaw in the traditional model, is that it implies a smooth and continuous progression across segments over the life of a product, whereas experience teaches just the opposite. Indeed, making the marketing and communications transition between any two adoption segments is normally excruciatingly awkward because you must adopt new strategies just at the time you have become most comfortable with the old ones.

The biggest problem during this transition period is the lack of a customer base that can be referenced at the time of making the transition into a new segment. As can be seen in the Technology Adoption Life Cycle image, the spaces between segments indicate the credibility gap that arises from seeking to use the group on the left as a reference base to penetrate the segment on the right.

The significance of this weakening in the reference base traces back to the fundamental point made about markets in the introduction: Namely, that markets — particularly high-tech markets — are made up of people who reference each other during the buying decision.

As we move from segment to segment in the technology adoption life cycle, we may have any number of references built up, but they may not be of the right sort.

Nowhere is this better seen than in the transition between visionaries and pragmatists. If there are to some extent minor gaps between the other adoption groups, between visionaries and pragmatists there is a great — and to a large extent, greatly ignored — chasm.

Starting to cross the chasm

If we look deep into that chasm, we see four fundamental characteristics of visionaries that alienate pragmatists. Visionaries lack respect for the value of colleagues’ experiences. Visionaries are the first people in their industry segment to see the potential of the new technology. Fundamentally, they see themselves as smarter than their opposite numbers in competitive companies — and quite often they are.

Indeed, it is their ability to see things first that they want to leverage into a competitive advantage. That advantage can only come about if no one else has discovered it. They do not expect, therefore, to be buying a well-tested product with an extensive list of industry references. Indeed, if such a reference base exists, it will almost certainly turn them off, indicating that for this technology, at any rate, they are already too late.

Visionaries take a greater interest in technology than in their industry. Visionaries are defining the future. You meet them at technology conferences and other futurist forums where people gather to forecast trends and seek out new market opportunities. They are easy to strike up a conversation with, and they understand and appreciate what high-tech companies and high-tech products are trying to do. They want to talk ideas with bright people. They are bored with the mundane details of their own industries. They like to talk and think high tech.

Pragmatists, on the other hand, deeply value the experience of their colleagues in other companies. When they buy, they expect extensive references, and they want a good number to come from companies in their own industry segment.

This situation can be further complicated if the high-tech company, fresh from its marketing successes with visionaries, neglects to change its sales pitch. Thus, the company may be trumpeting its recent success at early test sites when what the pragmatist really wants to hear about are up-and-running production installations. Or the company may be saying “state-of-the-art” when the pragmatist wants to hear “industry standard.”

It is easy to see why pragmatists are not anxious to reference visionaries in their buying decisions. Hence the chasm.

This, as we have already noted, creates a catch-22 situation; since there are usually only one or two visionaries per industry segment, how can you accumulate the number of references a pragmatist requires, when virtually everyone left to call on is also a pragmatist?

The problem goes beyond pitches and positioning, though. It is fundamentally a problem of time. The high-tech vendor wants — indeed, needs — the pragmatist to buy now, and the pragmatist needs — or at least wants — to wait. Both have absolutely legitimate positions. The fact remains, however, that somewhere a clock has been started, and the question is, who is going to blink first? For everyone’s sake, it had better be the pragmatist.

A war analogy

So how should we best attempt to cross this perilous chasm? Geoffrey uses a World War 2 analogy to carry his point across.

The long-term goal is to enter and take control of a mainstream market (Western Europe) that is currently dominated by an entrenched competitor (the Axis). For our product to wrest the mainstream market from this competitor, we must assemble an invasion force comprising other products and companies (the Allies).

By way of entry into this market, our immediate goal is to transition from an early market base (England) to a strategic target market segment in the mainstream (the beaches at Normandy). Separating us from our goal is the chasm (the English Channel).

We are going to cross that chasm as fast as we can with an invasion force focused directly and exclusively on the point of attack (D-Day). Once we force the competitor out of our targeted niche markets (secure the beachhead), then we will move out to take over adjacent market segments (districts of France) on the way toward overall market domination (the liberation of Western Europe).

How does the "D-Day" strategy help companies cross the chasm?

Companies just starting out, as well as any marketing program operating with scarce resources, must operate in a tightly bound market to be competitive. Otherwise their “hot” marketing messages get diffused too quickly, the chain reaction of word-of-mouth communication dies out, and the sales force is back to selling “cold.”

Cross the chasm by targeting a very specific niche market where you can dominate from the outset, drive your competitors out of that market niche, and then use it as a base for broader operations. Concentrate an overwhelmingly superior force on a highly focused target.

Most companies fail to cross the chasm because, confronted with the immensity of opportunity represented by a mainstream market, they lose their focus, chasing every opportunity that presents itself, but finding themselves unable to deliver a salable proposition to any true pragmatist buyer. The D-Day strategy keeps everyone on point — if we don’t take Normandy, we don’t have to worry about how we’re going to take Paris. And by focusing our entire might on such a small territory, we greatly increase our odds of immediate success.

Being sales vs. market driven when crossing the chasm

We do not have, nor are we willing to adopt, any discipline that would ever require us to stop pursuing any sale at any time for any reason. We are, in other words, not a market- driven company; we are a sales-driven company.

To put it simply, the consequences of being sales-driven during the chasm period are fatal.

Here’s why: The sole goal of the company during this stage of market development must be to secure a beachhead in a mainstream market — that is, to create a pragmatist customer base that is referenceable, people who can, in turn, gain us access to other mainstream prospects.

Therefore, whole product commitments must be made not only sparingly but also strategically — that is, made with a view toward leveraging them over multiple sales. This can only happen if the sales effort is focused on a single niche market. More than one, and you take on additional use cases, causing you to burn out your key resources, falter on the quality of your whole product commitment, and prolong your stay in the chasm.

Chemists talk to other chemists, lawyers to other lawyers, insurance executives to other insurance executives, and so on. Winning over one or two customers in each of five or ten different segments — the consequence of taking a sales-driven approach — will create no word-of-mouth effect. Your customers may try to start a conversation about you, but there will be no one there to reinforce it.

To be truly sales-driven is to invite a permanent stay.

By contrast, winning four or five customers in one segment will create the desired effect. Thus, the segment-targeting company can expect word-of-mouth leverage early in its crossing-the-chasm marketing effort, whereas the sales-driven company will get it much later, if at all. This lack of word of mouth, in turn, makes selling the product that much harder, thereby adding to the cost and the unpredictability of sales.

For all these reasons — for whole product leverage, for word-of-mouth effectiveness, and for perceived market leadership — it is critical that, when crossing the chasm, you focus exclusively on achieving a dominant position in one or two narrowly bounded market segments. If you do not commit fully to this goal, the odds are overwhelmingly against your ever arriving in the mainstream market.

Choosing the beachhead segment

When you are picking a chasm-crossing target it is not about the number of people involved, it is about the amount of pain they are causing.

The more serious the problem, the faster the target niche will pull you out of the chasm. Once out, your opportunities to expand into other niches are immensely increased because now, having one set of pragmatist customers solidly behind you, you are much less risky for others to back as a new vendor.

The fundamental principle for crossing the chasm is to target a specific niche market as your point of attack and focus all your resources on achieving the dominant leadership position in that segment as quickly as possible.

In one sense, this is a straightforward market-entry problem, to which the correct approach is well-known. First you divide up the universe of possible customers into market segments. Then you evaluate each segment for its attractiveness. After the targets get narrowed down to a very small number, the “finalists,” then you develop estimates of such factors as the market niches’ size, their accessibility to distribution, and the degree to which they are well defended by competitors. Then you pick one and go after it.

What’s so hard? The empirical answer here is, I don’t know, but nobody seems to do it very well.

Now, with that in mind, think about having to make what may be the most important marketing decision in the history of your enterprise with little or no useful hard information. For since we are trying to pick a target market segment that we have not yet penetrated to any great extent, by definition we also lack experience in that arena. Moreover, since we are introducing a discontinuous innovation into that market, no one has any direct experience with which to predict what will happen.

The market we will enter, by definition, will not have experienced our type of product before. And the people who have experienced our product before, the visionaries, are so different in psychographic profile from our new target customers — the pragmatists — that we must be very careful about extrapolating our results to date. We are, in other words, in a high-risk, low-data state.

Analysts and marketing data

We all know about lies, damned lies, and statistics, but for numeric marketing data we need to open up a whole new class of prevarication. This stuff is like sausage—your appetite for it lessens considerably once you know how it is made. In particular, the kind of market-size forecasts that come out of even the most highly respected firms — the ones that get quoted in the press as showing the bright and promising future for some new technology or product — are, by necessity, rooted in multiple assumptions. Each of these assumptions has enormous impact on the resulting projection, each represents an experienced but nonetheless arbitrary judgment of a particular market analyst, and all are typically well documented in the report, but also typically ignored by anyone who quotes from it. And once a number gets quoted in the press, then God help us — because it has become real.

And yet, that is what some people try to do. As soon as the numbers get up in a chart — or better yet, a graph — as soon as they thus become blessed with some specious authenticity, they become the drivers in high-risk, low-data situations because these people are so anxious to have data. That’s when you hear them saying things like “It will be a billion-dollar market in 2016. If we only get five percent of that market...”. When you hear that sort of stuff, exit gracefully, holding on to your wallet.

The only proper response to this situation is to acknowledge the lack of data as a condition of the process. To be sure, you can fight back against this ignorance by gathering highly focused data yourself. But you cannot expect to transform a low-data situation into a high-data situation quickly. And given that you must act quickly, you need to approach the decision from a different vantage point. You need to understand that informed intuition, rather than analytical reason, is the most trustworthy decision-making tool to use.

Informed intuition

The question is, How can we use this testimony to our advantage in crossing the chasm in a reasonable and predictable way? The key is to understand how intuition — specifically, informed intuition — actually works. Unlike numerical analysis, it does not rely on processing a statistically significant sample of data in order to achieve a given level of confidence. Rather, it involves conclusions based on isolating a few high-quality images — really, data fragments — that it takes to be archetypes of a broader and more complex reality. These images simply stand out from the swarm of mental material that rattles around in our heads. They are the ones that are memorable. So the first rule of working with an image is: If you can’t remember it, don’t try, because it’s not worth it. Or, to put this in the positive form: Only work with memorable images.

We need to work with something that gives more clues about how to proceed in the presence of real people with complex motives. However, since we do not have real live customers as yet — or at least, not very many of them — we are just going to have to make them up. Then, once we have their images in mind, we can let them guide us to developing a truly responsive approach to their needs. Target customer characterization is a formal process for making up these images, getting them out of individual heads and in front of a market development decision-making group.

Target market characterization

The idea is to create as many characterizations as possible, one for each different type of customer and application for the product. It turns out that, as these start to accumulate, they begin to resemble one another so that, somewhere between twenty and fifty, you realize you are just repeating the same formulas with minor tweaks, and that in fact you have outlined eight to ten distinct alternatives.

Once we have built a basic library of possible target customer profiles, we can then apply a set of techniques to reduce these “data” into a prioritized list of desirable target market segment opportunities. The quotation marks around data are key, of course, because we are still operating in a low-data situation. We just have a better set of material to work with.

Market development strategy checklist

This list consists of a set of issues around which go-to-market plans are built, each of which incorporates a chasm-crossing factor, as follows:

- Target customer

- Compelling reason to buy

- Whole product

- Partners and allies

- Distribution

- Pricing

- Competition

- Positioning

- Next target customer

The single most asked question: "Can’t we go after more than one target?". The simple answer is no. The more complex answer is also no, but it takes longer to explain. Just as you cannot hit two balls with one bat swing, hit two birds with one stone, or brush your teeth and your hair at the same time, so you cannot cross the chasm in two places.

Turning back to the checklist, the four factors that raise showstopper issues for crossing the chasm are as follows:

- Target customer: Is there a single, identifiable economic buyer for this offer, readily accessible to the sales channel we intend to use, and sufficiently well funded to pay the price for the whole product? In the absence of such a buyer, sales forces waste valuable time evangelizing groups of people trying to generate a sponsor. Sales cycles drag on forever, and the project can be shut down at any time.

- Compelling reason to buy: Are the economic consequences sufficient to make any reasonable economic buyer anxious to fix the problem called out in the scenario? If pragmatists can live with the problem for another year, they will. But they will continue to be interested in learning more. So your salespeople will be invited back again and again — they just won’t return with any purchase orders. Instead, they will report that the customer said, “Great presentation!” What the customer was really saying was “I learned some more and I didn’t have to buy anything.”.

- Whole product: Can our company with the help of partners and allies field a complete solution to the target customer’s compelling reason to buy in the next three months such that we can be in the market by the end of next quarter and be dominating the market within twelve months thereafter? The clock is ticking. We need to cross now, which means we need a problem we can solve now. Any thread left hanging could be the one that trips us up.

- Competition: Has this problem already been addressed by another company such that they have crossed the chasm ahead of us and occupied the space we would be targeting? Dick Hackborn, the HP executive who led the move into laser printers, had a favorite saying: “Never attack a fortified hill.” Same with beachheads. If some other company got there before you, all the market dynamics that you are seeking to make work in your favor are already working in its favor. Don’t go there.

When scenarios are scored against these four factors, 1 to 5, the worst aggregate score they can get is 4, the best 20, with higher-rated scenarios preferred. But there is an additional caveat. A very low score, relative to the others, in any of these factors almost always is a showstopper. So it is not just total score alone that matters. When in doubt, favor scenarios that have a high-rated compelling reason to buy. If they have already attracted a competitor, see if you can’t end-run them.

Here’s how they play out:

- Partners and allies: Do we already have relationships begun with the other companies needed to fulfill the whole product? If you do, it is typically from a single early-market project, or else you are just lucky. Pulling together this partnership is a major challenge for the whole product manager.

- Distribution: Do we have a sales channel in place that can call on the target customer and fulfill the whole product requirements put on distribution? Calling on the line-of-business side of the house requires some fluency in the language of the target niche, and established relationships with targeted buyers and users accelerates this process dramatically. Lacking this, companies typically hire a well-connected individual out of the target industry and charter her to lead the sales force back in.

- Pricing: Is the price of the whole product consistent with the target customer’s budget and with the value gained by fixing the broken process? Do all the partners, including the distribution channel, get compensated sufficiently to keep their attention and loyalty? Note here that it is the whole product price, not the price of the product per se, that matters. Services will often make up as much or more of this total as product.

- Positioning: Is the company credible as a provider of products and services to the target niche? At the outset, the answer is typically, "not very". One of the delights of niche marketing, however, is the speed at which this resistance can be overcome if only one truly commits to a whole product that fixes the broken process.

- Next target customer: If we are successful in dominating this niche, does it have good “bowling pin” potential? That is, will these customers and partners facilitate our entry into adjacent niches? This is an important issue of strategy. Chasm crossing is not the end, but rather the beginning, of mainstream market development. It is important that we have additional follow-on niches that can be lucratively addressed. Otherwise the economics of niche marketing simply do not hold up.

Committing to the point of attack

The good news in this is that you do not have to pick the optimal beachhead to be successful. What you must do is win the beachhead you have picked. If there is a genuine problem in the segment, you will have the target customer pulling for you. If it is a hard problem and the segment is reasonably small, you probably will not have competition to distract you. This means you can focus all your attention on the whole product, which is where it needs to be. Nail that and you win.

The enemy in the chasm is always time. You must force the pace at all times, even when in doubt, because standing still plays into the hands of the established vendors and the status quo.

The size of the segment matters

Finally when you are on the verge of making the commitment to the target segment, sooner or later the issue of how much revenue the segment might generate comes up. People think that bigger is better, but in fact this is almost never the case. To become going concern, a persistent entity in the market you need a market segment that will commit to you as its de facto standard for enabling a critical business process.

To become that de facto standard you need to win at least half, and preferably a lot more, of the new orders in the segment over the next year. That is the sort of vendor performance that causes pragmatist customers to sit up and take notice. At the same time, you will still be taking orders from other segments. So do the math.

If you find the target segment is too big, sub-segment it. But be careful here. You must respect word-of-mouth boundaries. The goal is to become a big fish in a small pond, not one flopping about trying to straddle a couple of mud puddles. The best sub-segmentation is based on special interest groups within the general community. These typically are very tightly networked and normally form because they have very special problems to solve. In the absence of such, geography can often be a safe sub-segmentation variable, provided that it affects the way communities congregate.

Summarizing the choosing of the right market segment:

Selecting the target market segment that will serves the point of entry for crossing the chasm into the mainstream market, the checklist as follows:

- Develop a library of taget customer scenarios. Draw from anyone in the company who would like to submit scenarios, but go out of your way to elicit input from people in customer-facing jobs. Keep adding to it until new additions are no more than minor variations on existing scenarios.

- Appoint a subcommittee to make the target market selection. Keep it as small as possible but include on it anyone who could veto the outcome.

- Have each member of the subcommittee privately rate each scenario on the showstopper factors. Roll up individual ratings into a group rating. During this process discuss any major disagreements about scores. This typically surfaces different points of view on the same scenario and is critical not just to getting the opportunity correctly in focus but also in laying out the groundwork for future consensus that will stick.

- Rank order the results and set aside scenarios that do not pass the first cut. This is typically about two-thirds of the submissions.

- Repeat the private rating and public ranking process on the remaining scenarios with the remaining selection factors. Narrow the scenario population down to, at most, a favored few.

- Depending on outcome, proceed as follows:

- Group agrees on beachhead segment. Go forward on that basis.

- Group cannot decide among final few. Give the assigment to one person to build a bowling pin model of market development, incorporating as many of the final few as is reasonable, and callint out a head pin. Attack the head pin.

- No scenario survived. That does happen. In that case, do not attempt to cross the chasm. Also, do not try to grow. Continue to take early-market projects, keep burn rate as low as possble, and continue the search for a viable beachhead.

Tips on whole product management

- Use the "doughnut diagram" to define — and then to communicate — the whole product. Shade in all the areas for which you intend your company to take primary responsibility. The remaining areas must be filled either by the customer or by partners or allies.

- Review the whole product to ensure it has been reduced to its minimal set. This is the KISS philosophy (Keep It Simple, Stupid). It is hard enough to manage a whole product without burdening it with unecessary bells and whistles.

- Review the whole product from each participant's point of view. Make sure each vendor wins, and that no vendor gets an unfair share of the pie. Inequities here, particularly when they favor you, will instantly defeat the whole product effort - companies are naturally suspicious of each other anyway, and given any encouragement, will interpret your entire scheme as a rip-off.

- Develop the whole product relationship slowly, working from existing instances of cooperation towards a more formalized program. Do not try to institutionalize cooperation in advance of credible examples that everyone can benefit from it - not the least of whom should be the customers. Also, do not recruit directly competing partners to serve the same need in the same segment - this will only discourage them from making a full commitment to your program.

- With large partners, try to work from the bottom up; with small ones, from the top down. The goal in either case is to work as close as possible to where decisions that affect the customer actually get made.

- Once formalized relationships are in place, use them as openings for communication only. Do not count on them to drive cooperation. Partnerships ultimately work only when specific individuals from the different companies involved choose to trust each other.

Define the battle

How far must one go to serve one's customers? Well, in the case of crossing the chasm, one of the key things as a pragmatist customer insists on seeing is viable competition. If you are fresh from developing a new value proposition with visionaries, that competition is not likely to exist - at least not in a form that a pragmatist would apprecite. What you to do then is create it.

Creating the competition

In the progression of the Technology Adoption Life Cycle, the nature of competition changes dramatically. These changes are so radical that, in a very real sense, one can say at more than one point in the cycle that one has no obvious competition. Unfortunately, where there is no competition, there is no market.

In sum, the pragmatists are loath to buy until they can compare. Competition, therefore, becomes a fundamental condition for purchase. So, coming from the early market, where there are typically no perceived competing products, with the goal of penetrating the mainstream, you often have to go out and create your competition.

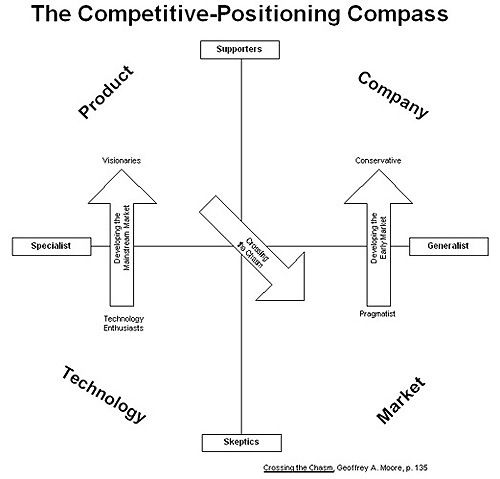

The competitive positioning compass

There are four domains of value in high-tech marketing: technology, product, market, and company. As products move through the Technology Adoption Life Cycle, the domain of greatest value to the customer changes.

In the early market, where decisions are dominated by technology enthusiasts and visionaries, the key value domains are technology and product. In the mainstream where decisions are dominated by pragmatists and conservatives the key domains are market and company. Crossing the chasm, in this context, represents a transition from prodcut-based to market-based values.

The "chasm transition" represents an unnatural rhythm. Crossing the chasm requires moving from an environment of support among the visionaries back into one of skepticism among the pragmatists. It means moving from the familiar ground of product-oriented issues to the unfamiliar ground of market-oriented ones, and from the familiar audience of like-minded specialists to the unfamiliar audience of wary generalists.

To sum it up, it is the market-centric value system — supplemented (but not superseded) by the product-centric one — that must be the basis for the value profile of the target customers when crossing the chasm.

More specifically, creating the competition involves using two competitors as beacons so that the market can locate your company's unique value proposition.

The first of these two competitors we will call the market alternative. This is a vendor that the target customer has been buying from for years. The problem they address is the one we will address, and the budget that is allocated to them represents the money we as the new entrant are going to preempt. To earn the right to this budget, we are going to use a disruptive innovation to address a stubbornly problematic limitation in the traditional offer.

The second reference competitor we will call the product alternative. This is a company that is also harnessing the same disruptive innovation we are — or at least close to it — and is positioning itself like us as a technology leader. Their very existence gives credibility to the notion that now is the time to embrace this new discontinuity. Our intent here is to acknowledge their technology but to differentiate from them by virtue of our own segment-specific focus.

[Geoffrey in his book proceeds to list a couple of real-life examples of companies that have successfully been able to position themselves and companies that failed to do this properly...]

Chasm crossing requires a single target beachhead segment, and in that segment, there needs to exist already the budget dollars to buy your offer. To be sure, the budget will be "misnamed", because it will be allocated to some brain-dead, ineffective "band-aid" approach to solving what has become a broken, mission-critical process. But it must exist, or else you will lose a full year just in educating the market to put aside money that might be used to buy your product in the following year.

Choosing your market alternative wisely is the solution to this problem. But it has to be credible. And understand that, as soon as you call out your choice, you are in for a fight. That market alternative, whoever it may be, had plans for the money you are targeting. Indeed, it considers that budget as its budget, and it will not take kindly to your actions.

That's where the product alternative comes in. You need to make clear to everyone involved that a technology shift is under way here and that old solutions simply cannot hope to keep up. Trade magazines on their best day cannot be interactive. Direct mail programs on their best day cannot catch me at the golf course. General agents on their best day cannot provide round-the-clock answers to consumer quesitons at least not cost-effectively. It is not your intent to deride the peformance of the established "old guard". Indeed, you should honor it, as your target customer has long-standing relationships with these vendors. Rather, it is to suggest that a new wave is coming, and that you intend to domesticate that technology to the same ends as these tried-and-true solution providers.

Positioning

Positioning is the most discussed and least understood component of high-tech marketing. You can keep yourself from making most positioning gaffes if you will simply remember the following principles:

- Positioning, first and foremost, is a noun, not a verb. That is, it is best understood as an attribute associated with a company or a product, and not as the marketing contortions that people go through to set up that association.

- Positioning is the single largest influence on the buying decision. It serves as a kind of buyers' shorthand, shaping not only their final choice but even the way they evaluate alternatives landing up to that choice. In other words, evaluations are often simply rationalizations of preestablished positioning.

- Positioning exists in people's heads, not in your words. If you want to talk intelligently about positioning, you must frame a position in words that are likely to actually exist in other people's heads, and not in words that come straight out of hot advertising copy.

- People are highly conservative about entertaining changes in positioning. This is just another way of saying that people do not like messing with the stuff that is inside their heads. In general, the most effective positioning strategies are the ones that demand the least amount of change.

Given all of the above, it is then possible to talk about positioning as a verb — a set of activities designed to bring about pistioning as a noun. Here there is one fundamental key to success: When most people think of positioning this way, they are thinking about how to make their products easier to sell. But the correct goal is to make them easier to buy.

Companies focus on making products easier to sell because that is what they are worried about — selling. To prospective customers this can be a complete turnoff.

Think about it. Most people resist selling but enjoy buying. By focusing on making a product easy to buy, you are focusing on what the customers really want. In turn, they will sense this and reward you with their purchases. Thus easy to buy becomes easy to sell. The goal of positioning, therefore, is to create a space inside the target customer's head called "best buy for this type of situation" and to tattain sole, undisputed occupancy of that space. Only then, when the green light is on, and there is no remaining competing alternative, is a product easy to buy.

Now the nature of that best-buy space is a function of who is the target customer. Indeed, this space builds and expands cumulatively as the product passes through the Technology Adoption Life Cycle. There are four fundamental stages in this process, corresponding to the four primary psychographic types, as follows:

- Name it and frame it. Potential customers cannot buy what they cannot name, nor can they seek out the product unless they know what category to look under. This is the minimum amount of positioning needed to make the product easy to buy for a technology enthusiast. The goal here is to create a technically accurate description of the disruptive innovation that puts it into its ontologically correct category with a descriptive modifer that sets it apart from the other members of that category [Geoffrey proceeds to list a couple of examples of such positioning].

- Who for and what for. Customers will not buy something until they know who is going to use it and for what purpose. This is the minimum extension to positioning needed to make the product easy to buy for the visionary. Visionaries do not care about the ontology of the new innovation — they care about its potential impact. What disruptive change can it enable in their environment that they can leverage for dramatic competitive advantage [Geoffrey proceeds to use same examples above where this positioning approach is applied]. The key idea here is to focus on "So what?" and the "Who cares?" parts of the value proposition.

- Competition and differentiation. Customers cannot know what to expect or what to pay for a product until they can place it in some sort of comparative context. This is the minimum extension to positioning needed to make a product easy to buy for a pragmatist. This is by definition a post-chasm situation, for the category is now sufficiently viable that there are multiple vendors competing to fill the same budget.

- Financials and futures. Customers cannot be completely secure in buying a product until they know it comes from a vendor with staying power who will continue to invest in this product category. This is the final extension of positioning needed to make a product easy to buy for a conservative.

These four positioning strategies correspond to the four quadrants of the Positioning Compass (image above). The key takeaway from this section is that positioning is more about the audience's state of mind than yours. Most failed positioning statements arise from vendors being unable to see themselves from someone else's point of view.

The positioning process

When positioning is thought of primarily as a verb, it refers to a communications process with four key components:

- The claim. The key here is to reduce the fundamental position statement — a claim of undisputable market leadership within a given target segment — to a two-sentece format.

- The evidence. The claim to undisputed leadership is meaningless if it can, in fact, be disputed. The key here is to present sufficient evidence as to make any such disputation unreasonable.

- Communications. Armed with claim and evidence, the goal here is to identify and address the right audiences in the right sequence with the right versions of the message.

- Feedback and adjustment. Just as football coaches have to make halftime adjustments ot their game plans, so do marketers, once the positioning has been exposed to the competition. Competitors can be expected to poke holes in the initial effort and these need to be patched up or otherwise responded to.

This last component makes positioning a dynamic process rather than one-time event. As such, it means marketers revisit the same audiences many times over during the life of a product. Establishing relationships of trust, therefore, rather than wowing them on one-time basis, is key to any ongoing success.

The claim: Passing the elevator test

Of the four components by far the hardest to get right is the claim. It is not that we lack for ideas, usually, but rather that we cannot express them in any reasonable span of time. Hence the elevator test: Can you explain your product in the time it takes to ride up in an elevator? Venture capitalists use this all the time as a test of investment potential. If you cannot pass the test, they don't invest. Here's why:

- Whatever your claim is, it cannot be transmitted by word of mouth. In this medium the unit of thought is at most a sentence or two. Beyond that, people cannot hold it in their heads. Since we have already established that word of mouth is fundamental to success in high-tech marketing, you must lose.

- Your marketing communications will be all over the map. Every time someone writes a brochure, a presentation, or an ad, they will pick up the claim from some different corner and come up with yet another version of the positioning. Regardless of how good this version is, it will not reinforce the previous versions, and the marketplace will not get comfortable that it knows your position. A product with an uncertain position is very difficult to buy.

- Your R&D will be all over the map. Again, since there are so many different dimensions to your positioning, engineering and product marketing can pick any number of different routes forward that may or may not add up to a real market advantage. You will have no clear winning proposition but many strong losing ones.

- You won't be able to recruit partners and allies, because they won't be sure enough about your goals to make any meaningful commitments. What they will say instead, both to each other and to the rest of the industry, is "Great technology — too bad they can't market."

- You are not likely to get financing from anybody with experience. As just noted, most savvy investors know that if you can't pass the elevator test, among other things, you do not have a clear — that is, investable — marketing strategy.

So how can we guarantee passing the elevator test? The key is to define your position based on the target segment you intend to dominate and the value proposition you intend to dominate it with. This is the who for and what for positioning statement that resonates with visionaries and kicks off the early market competition. At the same time, you also want to foreshadow your mainstream market future, leveraging the competition and differentiation positioning relative to market and product reference competitors.

Here is a proven formula for getting all this down into two short sentences. Try it out on your own company and one of its key products. Just fill in the blanks:

- For (target customers - beachhead segment only)

- Who are dissatisfied with (the current market alternative)

- Our product is a (product category)

- That provides (compelling reason to buy).

- Unlike (the product alternative),

- We have assembled (key whole product features for your specific application).

[Geoffrey proceeds to give some concrete examples of this formula...]

Now what is often interesting about writing a statement like this is not what you write down but what you have to give up. Wouldn't it have been better in both cases to have included extra value statements for a bigger effect?

The answer here is an emphatetic no. Indeed, this is just what defeats most positioning efforts. Remember, the goal of positioning is to create and occupy a space inside the target customers' head. Now, as we already noted, people are very conservative about what they let you do inside their head. One of the things they do not like is for you to take up too much space.

It's like a telegram with less than one line. If you don't make the choice to fill the space with a single attribute, then market will do it for you. And since the market includes your competition trying to de-position you, don't count on it to be kind.

One final point on claims: The statement of position is not the tagline for the ad. Ad agencies come up with taglines, not marketing groups. The function of the statement of position is to control the ad campaign, to ensure that however "creative" it may become, it stays on strategy. If the point of the ad is not identical with the point of the claim, then it is the ad, not the claim, that must be changed —regardless of how great the ad is.

The shifting burden of proof

The kind of evidence and proof that is needed evolves over the course of the Technology adoption Life Cycle [Geoffrey showcases a lot of different materials in the context of providing proof to prospects, such as benchmarks, demos, architecture diagrams etc.].

In sum, to the pragmatist buyer, the most powerful evidence of leadership and likelihood of competitive victory is market share. In the absence of definitve numbers here, pragmatists will look to the quality and number of partners and allies you have assembled in your camp and their degree of demonstrable commitment to your cause. The operating principle here is that you identify leaders by their followers.

Product launches

When crossing the chasm, instead of communicating "look at this hot new product", the message that will resonate is more likely to be "look at this hot new market". This message typically consists of a description of the emerging new market, anchored by a new approach to a problem stubbornly resistant to conventional solutions, fed by an emerging set of partners and allies, each supplying a part of the whole.

The product does not even have to be the centerpiece of the "whole product" — it just has to be an indispensable component.

Recap: The competitive positioning checklist

To define the battle effectively so that you win the business of a pragmatist buyer, you must:

- Focus on the competition within the market segment established by your must-have value proposition — that is, that combination of target customer, product offering, and compelling reason to buy that establishes your primary reason for being.

- Create the competition around what, for a pragmatist buyer, represents a reasonable and reasonably comprehensive set of alternative ways of achieving this value proposition. Do not tamper with this set by artificially excluding a reasonable competitor — nothing is more likely to alienate your pragmatist buyer.

- Focus your communications by reducing your fundamental competitive claim to a two-sentence formula and then managing every piece of company communication to ensure that it always stays within the bounds set out by that formula. In particular, always be sure to reinforce the second sentence of this claim, the one that identifies your primary competition and how you are differentiated from it.

- Demonstrate the validity of your competitive claim through the quality of your whole product solution and the quality of your partners and allies, so that the pragmatist buyer will conclude you are, or must shortly become, the indisputable leader of this competitive set.

Launching the invasion

The number-one corporate objective, when crossing the chasm, is to secure a distribution channel into the mainstream market, one which the pragmatist customer will be comfortable with. This objective comes before revenues, before profits, before press, even before customer satisfaction.

To sum up, when crossing the chasm, we are looking to attract customer-oriented distribution with one of our primary lures being distribution-oriented pricing.

Customer-oriented distribution

The world of high-tech sales, marketing and distribution has been changing dramatically in recent decades. Essentially, these group into five classes each of which is associated with an optimal approach:

- Enterprise executives making big-ticket purchasing decisions focused on complex systems to be adopted broadly across their companies,

- End users making relatively low-cost purchasing decisions focused on personal or workgroup technologies to be adopted locally and individually,

- Department heads making medium-cost purchasing decisions for use-case-specific solutions that will be adopted within their own organization,

- Engineers making design decisions for products and services to be sold to their company's customers, and

- Small business owner-operators making modest purchase decisions that are nonetheless highly material to them, given limited capital to spend and a strong need to get value back.

Direct sales and the enterprise buyer

Enterprise buyers making major systems purchases expect to pay hundreds of thousands or millions of dollars. In that context they are looking for a consultative sales experience that identifies their key needs and custom-fits the vendor's offering to meet them. The direct sales approach meets this expectation via a top-down approach to marketing, sales and delivery.

Once the sales motion is under way, the normal approach is called solution selling, in essence a whole-product tailoring job to meet the specific needs of a particular prospect.

In either case the vendor will be sending a highly accomplished executive to meet first with a senior member of the prospect company's management team to ascertain if there is a sponsorship and then with various middle managers to do a needs analysis and develop a proposal. From there the goal is to win the nod and get the contract through purchasing, the PO signed, and the work under way.

Web-based self-service and the end-user buyer

In total contrast to enterprise buyers, end users purchasing technology for themselves expect to pay perhaps hundreds of dollars per purchase or tens of dollars per month - and that is often after a free trial. In that context they are looking for a transactional sales experience that is primarily self-service. The world wide web is terrific at providing just that. Marketing on the web is primarily promotional marketing, often driven by a free offer or trial period.

Sales 2.0 and the department manager buyer

Departmental buyers making IT purchases are caught in a bind. Because they are part of a larger enterprise, they need systems that pass muster in that context. But they have neither the budget nor the staff to support such acquisitions. Historically they have had to settle for cobbled-together solutions of highly variable quality. Internet has created a new alternative sales channel, what some are calling sales 2.0.

Sales 2.0 consists of direct-touch marketing, sales and service conducted entirely over digital media. The marketing looks a lot like the web-based self-service transactional marketing for end users. The difference arises when the prospect clicks on a link. Instead of going to an automated response system, the click alerts a human salesperson.

Value-Added Resellers (VAR) and the small business owner

Small business owners are really just consumers wearing a different hat. Their allies are value-added resellers, often sole proprietors themselves, who run low-overhead businesses that are always hungry for new customers.

Vendors who target the truly small business customer must take virtually all of the responsibility for marketing, and most of it for sales, while almost none for post sales support — this last is what the VAR really does for a living.

Distribution-oriented pricing

Pricing decisions are among the hardest for management groups to reach a consensus on.

Customer oriented pricing

Visionaries — the customers dominating the early market's development — are relatively price insensitive. Seeking a strategic leap forward, with an order-of-magnitude return on investment, they are convinced that any immediate costs are insignificant when compared with the end result.

At the other end of the market are the conservatives. They want low pricing. They have waited long time before buying the product — long enough for complete institutionalization of the whole product, and long enough for prices to have dropped to only a small margin above cost. This is their reward for buying late. They don't get competitive advantage, but they do keep their out-of-pocket costs way down. This is cost-based pricing, something that will eventually emerge in any mainstream market, once all the other margin-justifying elements have been exhausted.

Between these two types lie the pragmatics — our target customers for the chasm-crossing effort. Pragmatists, as we have said repeatedly, want to back the market leader. They have learned that by so doing they can keep their whole product costs — the costs not only of purchase but of ownership as well — to their lowest, and still get some competitive leverage from the investment. They expect to pay a premium price for the market leader relative to the competition, perhaps as high as 30 percent. This is competition-based pricing. Even though the market leaders are getting a premium, their allowed price is still a function of comparison with the other players in the market. And if they are not the market leader, they will have to apply the reverse of this rule and discount accordingly.

Form the customer perspective, the key issue when crossing the chasm is market leadership versus a viable competitive set, captured by comparison to your two reference competitors, and the key pricing strategy is premium margin above a norm set by these comparisons. That is, you have earned a premium over the market alternative because you have next-generation technology and a premium over the product alternative because you have invested to orchestrate a segment-specific whole product.

Vendor-oriented pricing

Vendor-oriented pricing is a function of internal issues, beginning with cost of goods, and extending to cost of sales, cost of overhead, cost of capital, promised rate of risk-adjusted return, and any number of other factors. These factors are critical to being able to manage an enterprise profitably on an ongoing basis. None of these, however, has any immediate meaning in the marketplace. They take on meaning only as they impact other market-visible issues.

For example, vendor-oriented pricing typically sets the distribution channel decision by establishing a price-point ballpark that puts the product in the direct sales, web self-service, or sales 2.0 camp. Moreover, once the product is in the market, vendor-oriented factors can make a big impact if, for example, they allow for a low-cost pricing advantage in a late mainstream market, or if they allow for operating margins that can fund new R&D for the next early market.

Each of the price points will call into being a different management perspective on the sales funnel, top to bottom, from suspect to prospect to qualified lead all the way to closed customer. The higher the volume, the more transactional the process, and the more you depend on filling the top of the funnel. The higher the price, the more relationship-oriented the process, the more you focus on the bottom of the funnel. And yes, with Sales 2.0 you do tend to focus most on the middle of the funnel, where process effectiveness and efficiency have their biggest impacts.

Distribution-oriented pricing

From a distribution perspective, there are two pricing issues that have significant impact on channel motivation:

- Is it priced to sell?

- Is it worthwhile to sell?

Being priced to sell means that price does not become a major issue during the sales cycle. Companies crossing the chasm, coming from success in the early market with visionary customers, typically have their products priced too high.

Recap: Invasion launching

To sum up, the last step in the strategy for crossing the chasm is launching the invasion — that is, putting a price on your product and putting it into a sales channel. Neither of these actions resolves itself readily into a checklist of activities, but there are four key principles to guide us:

- The prime goal is to secure access to a customer-oriented distribution channel. This is the channel you predict that mainstream pragmatist customers would expect and want to buy your product from.

- The type of channel you select for long-term servicing of the market is a function of the price point of the product. If this is not direct sales, however, then during the transition period of crossing the chasm, you may need to adopt a supplementary or even an alternative channel — one oriented toward demand creation — to stimulate early acceptance in the mainstream.

- Price in the mainstream market carries a message, one that can make your product easier — or harder — to sell. Since the only acceptable message is one of market leadership, your price needs to convey that, which makes it a function of the pricing of comparable products in your identified competitive set.

- Finally, you must remember that margins are the channel's reward. Since crossing the chasm puts extra pressure on the channel, and since you are often trying to leverage the equity the channel has in its existing relationships with pragmatist customers, you should pay a premium margin to the channel during the chasm period.

Leaving the chasm behind

The fundamental lesson of this chapter is a simple one: The post-chasm enterprise is bound by the commitments made by the pre-chasm enterprise. These pre-chasm commitments, made in haste during the flurry of just trying to get a foothold in an early market, are all too frequently simply unmaintainable in the new situation. That is, they promise a level of performance or reward that, if delivered, would simply destroy the enterprise.

This means that one of the first tasks of the post-chasm era may well be to manage one's way out of the contradictions imposed by pre-chasm agreements.

This, in turn, can involve a major devaluation of the assets of the enterprise, significant demotions for people who are unsuited to the responsibilities implied by their titles, and marked changes in authority over the future of the product and technology — all of which is likely to end in bitter disappointments and deep-seated resentment. In short, it can be a very nasty period indeed.

The first and best solution to this class of problems is to avoid them altogether — that is, avoid making the wrong kind of commitments during the pre-chasm period. By looking ahead we can vaccinate ourselves against making the kind of crippling decisions that doom so many otherwise promising high-tech enterprises. This is of course much harder to achieve than it looks.

To leave the chasm behind, there is a molting process that must occur, a change of company self, wherein we grow away from celebrating familial feelings and dashing individual performances and step toward rewarding predictable, orchestrated group dynamics. It is not a time to cease innovation or to sacrifice creativity. But there is a call to redirect the energy toward the concerns of a pragmatist's value system instead of a visionary's.

There is a more general principle that can help entrepreneurs think through their management of capital for marketing purposes. In this realm, it is typically more capital intensive to cross the chasm than it is to build the early market. Early market development efforts typically do not respond well to massive infusions of capital. You simply cannot spend your way into the hearts and minds of technology enthusiasts and visionaries.

The people effect of leaving the chasm

Once you have crossed the chasm, the pioneers of the organization can become a potential liability. Their fundamental interest is to innovate, not administrate. Things like industry standards and common interfaces and adaptations to installed solutions, especially when these solutions are clearly technically inferior, are all foreign and repugnant to the high-tech pioneers. So as the market infrastructure begins to close in around them, they are already looking for less crowded country.

In the meantime, they are not likely to cooperate in the compromises needed and can be highly disruptive to groups that are seeking to carry this agenda out. It is critical, therefore, that as the enterprise shifts from the product-centric world of the early market to the market-centric world of the mainstream, pioneer technologists be transferred elsewhere — either to another, more futuristic project within the enterprise, or if that is not an option, to another company where their talents can be better utilized.